MIC (Market Intelligence & Consulting Institute) held the 36th MIC FORUM Fall from October 30 to November 2. Today, MIC released its findings on both global and Taiwan semiconductor Industries, focusing on the opportunities for third-category semiconductor manufacturers, and addressing how the ICT industry is facing global net-zero pressure and strategizing for short, medium, and long-term responses.

Surveying the global semiconductor trends, the overall economic weakness and sluggish end-demand since 2023 have resulted in subdued enthusiasm in both commercial and consumer markets. This has affected businesses from end-consumer product manufacturers to semiconductor supply chain players, all grappling with high inventory levels and insufficient pull-in demand. Looking ahead to 2024, with major memory manufacturers controlling production cuts and stabilizing prices, it is anticipated to be a significant driving force for global semiconductor market growth from 2024 to 2026.

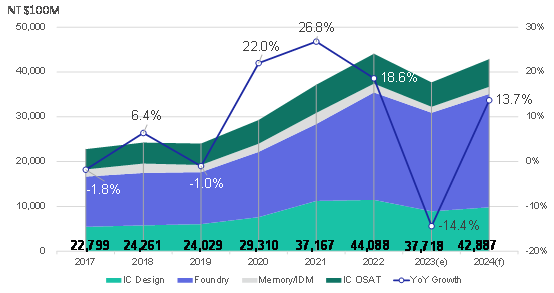

Taiwan Semiconductor Industry Shipment Value, 2017-2024

Note: US$1=NT$31.9

Source: MIC, November 2023

The shipment value of Taiwan's semiconductor industry, comprising of IC design, wafer foundry, memory/IDM (Integrated Device Manufacturing), and IC packaging and testing industry sectors, is estimated to be NT$3.77 trillion (US$118 billion) in 2023, according to MIC. Looking ahead to 2024, it is anticipated that the industry's shipment value will reach NT$4.29 trillion (US$134.5 billion), marking an impressive growth of 13.7% year-on-year. Various semiconductor industry sectors are expected to experience growth ranging from 10% to 20% in 2024. Among them, the wafer foundry industry sector is anticipated to remain a primary driver, particularly in advanced manufacturing segments.

Looking forward to 2024, while the first quarter is expected to face a traditional off-season for semiconductors, it is already showing better performance compared to the same period this year, breaking the trend of four consecutive quarters of year-on-year decline. In the memory sector, due to ongoing production cuts by international memory giants, short-term memory prices are expected to stabilize, leading to a potential restoration of supply-demand equilibrium.

In terms of the IC design and packaging and testing industry sectors, given their significant association with end-consumer electronics products, they may prove more challenging in the coming two quarters as they are unlikely to achieve the same level of value recovery as wafer foundry industry sector, which benefits from advanced processes.

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a major government think tank, and one of the leading IT research in Taiwan. MIC specializes in industry and market research. With over three decades of experience, MIC provides valuable insights and data-driven recommendations to assist businesses in making informed decisions.

To know more about this topic, please visit: 2022 Recap and 2023 Development of the Global IC Design Industry, Development of the China IC Packaging and Testing Industry and Key Players, 2022 Recap and 2023 Development of the Worldwide Semiconductor Foundry Industry, Taiwanese Semiconductor Industry Landscape, 2023 and Beyond, Taiwan IC Packaging and Testing Industry, 2Q 2023, Taiwan Fabless IC Industry, 2Q 2023, Taiwan Semiconductor Manufacturing Industry, 2Q 2023

For future receipt of press releases, please subscribe here

To know more about MIC research findings, please access our website.

For future inquiry, please contact MIC Public Relations

If you prefer not to receive notifications, please click here to unsubscribe